A Placemaking Journal

Dream Home for the New Era: Compact, connected & mortgage-free?

The future is here. And it’s for lease.

The future is here. And it’s for lease.

Even before the Great Recession, real estate market analysts Todd Zimmerman, Laurie Volk and Chris Nelson were patiently explaining the demography-is-destiny argument for an inevitable shift in American housing. It’s all about the numbers.

Between them, two monster generational cohorts, Boomers (born 1946-1964) and Millennials (born 1981-2000), account for more than 150 million people. There’s broad diversity within members of the generations when it comes to attitudes and capacities for acting on them, of course. But there are so just so darn many people in the two age groups that even small slivers of the total number will have multiplier effects on housing supply and demand.

The difference-making population slivers may not be all that small, it turns out. These age groups both trend away from family norms of the past. Many more of them at both ends of the age clusters live alone or have no children.

What’s more, many in both generations seem more interested in compact, mixed-use neighborhoods than in car-centric, single-use suburban housing. The National Association of Realtors’ 2011 Community Preference Survey is among the latest of the attitudinal checks. In that report, 58% of respondents indicated a preference for “a neighborhood with a mix of houses and stores and other businesses within an easy walk.”

Since the pre-recession housing boom was producing nothing like a 60/40 mix of mixed-use, walkable neighborhoods compared to drive-to ‘burbs, we can assume a pent-up demand for the Smart Growth stuff. And that was before the housing bust and rising gas prices began forcing Americans to rethink what, exactly, constitutes an affordable version of how and where they want to live.

In an article in the Nov./Dec. 2010 Washington Monthly, Patrick C. Doherty and Christopher Leinberger characterized the dilemma this way: “Both of these huge demographic groups want something that the U.S. housing market is not currently providing: small, one-to-three-bedroom homes in walkable, transit-oriented, economically dynamic, and job-rich neighborhoods.”

For many folks in those two generations, the combination of economic realities and quality of life desires are pushing them towards rentals.

“The country is on the cusp of fundamental changes in our housing dynamics,” said Doug Bibby, president of the National Multi-Housing Council in a January online story for Multifamily Executive. “Preferences are driving more people away from the typical suburban house and toward the type of lifestyle that rental housing offers.”

Housing industry trend watchers have been all over this story for the better part of a year. Now, everybody else is picking up on it. The Birmingham News made note last week of the against-the-grain growth of downtown residences in a down market for home sales. In the decade between 2000 and 2010, downtown Birmingham residents increased by 32 percent and the number of occupied rental units by 18 percent.

The New York Times weighed in with a story on how demand for rental housing is outstripping supply and driving up rents. And the debate is heating up among developers and builders on how much to invest in this new direction. Is the rental explosion a temporary trend that will revert to old home-ownership patterns when the economy picks up? Or are we, as Bibby and the demographic analysts suggest, into a whole new housing era?

I’ve been convinced by Zimmerman/Volk, Nelson and others that the shift to a higher proportion of rental housing is at least long-term, if not permanent. And I was on a panel at the International Building Show in Orlando earlier this month with multifamily experts whose numbers were even more compelling.

Lesley Deutch of John Burns Real Estate Consulting said her research suggests “a 9.1 million increase in renter households over the next five years, more than double the rate of the last five years.” And the trends driving those numbers are not likely to fade anytime soon.

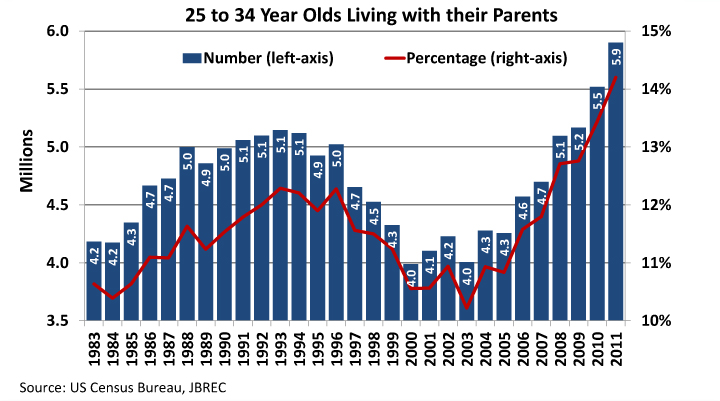

The Millennials, many of whom are stuck living with their parents until job prospects give them the bucks to move out on their own, account for much of the pent-up demand.

For the just-starting-out generation, tight credit and requirements for substantial down payments will continue to be barriers to home ownership. And even when they have incomes sufficient to invest, continuing volatility in the overall economy will dissuade them from putting their money into something they can’t pick up and take with them if they have to chase better jobs elsewhere.

So here’s what we have: A giganto demographic push towards flexible, close-in living; a demand for affordability on a broad scale; and an increasing desire for rental options. What this suggests for municipalities and private developers is an opportunity with a challenge.

Obviously, there’s a chance now to expand housing choices in places people want to live and to achieve all the advantages that come with appropriate density. More diversity. Better options for aging in place. Increased economic vitality via the hanging-out effect.

The problem is, outside of big city downtowns, where demand for rentals has always been high, the design and construction of apartments, town houses and other rental models haven’t consistently measured up to the range and standards of single-family, for sale residences. In too many places, “for rent” and “affordable” have become code words for subsidized government housing or cheaply built complexes likely to be opposed by neighbors worried about their property values or the increased traffic congestion. There’s a stigma to overcome.

The sure way to aggravate in-town neighborhood fears is to import suburban multifamily designs that assume no one can live without a parking space outside their door. Or relate to human beings who are not fellow occupants of their rented space. The ideal approach would be to produce neighborhood-appropriate rental choices that are impossible to tell from for-sale dwellings.

Historic in-town neighborhoods provide the best models. True townhouses. Appropriately scaled stacked flats. And, of course, single-family detached homes that toggle between owner-occupied and rented depending upon market conditions and owner preferences.

That latter approach is getting a significant try-out — and plenty of kudos — in Ocean Springs, MS. The evolution of Katrina Cottage clusters into rental neighborhoods is in full swing. Last week, there was a celebration of LEED Platinum certification of one of the homes in the Cottages at Oak Park.

Designed from the beginning as rentals, the 29 homes are on two-plus acres within walking and biking distance of everything in the historic waterfront town. Construction was complete in August of last year. And just about every cottage was leased within 60 days.

–Ben Brown

If PlaceShakers is our soapbox, our Facebook page is where we step down, grab a drink and enjoy a little conversation. Looking for a heads-up on the latest community-building news and perspective from around the web? Click through and “Like” us and we’ll keep you in the loop.